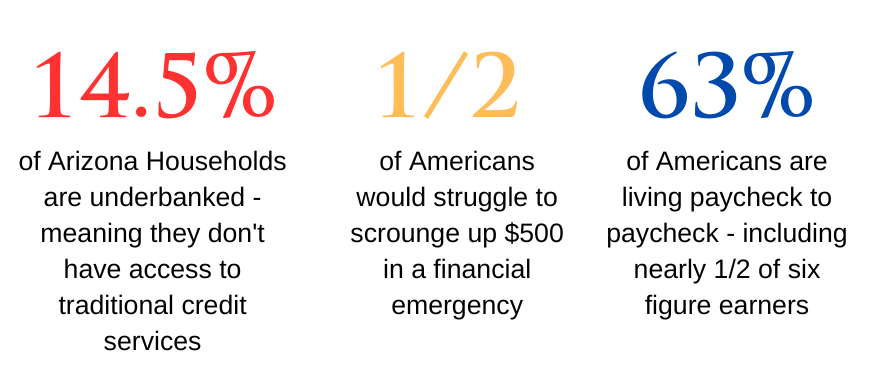

Arizonans Deserve Access To Credit In A Financial Emergency

14.5 percent of Arizonans are considered “underbanked” meaning they don’t have access to traditional credit services. Arizonans should have the right to make their own financial choices without the government telling them what they can or can’t do. From unexpected medical bills, automotive issues, or circumstances beyond their control, Arizonans need to have options available in an emergency.

Short-Term Borrowers Are Overwhelmingly Satisfied

A majority of short-term borrowers are overwhelmingly satisfied and value the products and services provided by short-term credit providers. Less than one percent of all complaints submitted to the Consumer Finance Protection Bureau (CFPB) were related to short-term credit products.

Regulating Short-Term Lenders Out Of Business Hurts, Rather Than Helps, Arizonans

Onerous financial regulations that essentially eliminate access to short-term credit, leads to higher bankruptcies, consumer complaints, more expensive borrowing options, and a market for unscrupulous lenders.

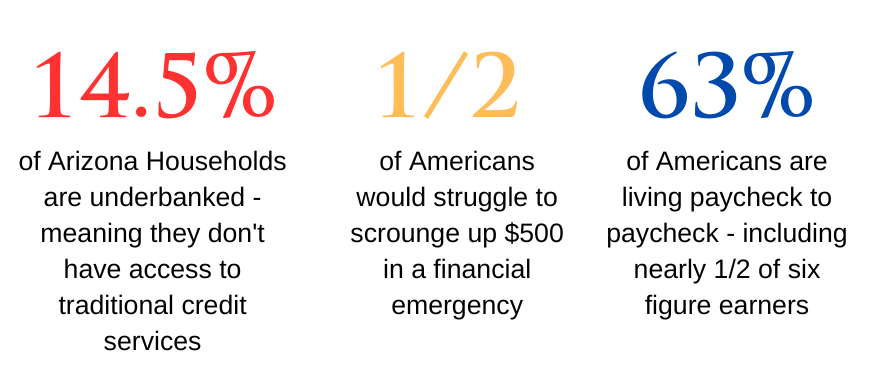

Arizonans Deserve Access To Credit In A Financial Emergency

14.5 percent of Arizonans are considered “underbanked” meaning they don’t have access to traditional credit services. Arizonans should have the right to make their own financial choices without the government telling them what they can or can’t do. From unexpected medical bills, automotive issues, or circumstances beyond their control, Arizonans need to have options available in an emergency.

Short-Term Borrowers Are Overwhelmingly Satisfied

A majority of short-term borrowers are overwhelmingly satisfied and value the products and services provided by short-term credit providers. Less than one percent of all complaints submitted to the Consumer Finance Protection Bureau (CFPB) were related to short-term credit products.

Regulating Short-Term Lenders Out Of Business Hurts, Rather Than Helps, Arizonans

Onerous financial regulations that essentially eliminate access to short-term credit, leads to higher bankruptcies, consumer complaints, more expensive borrowing options, and a market for unscrupulous lenders.

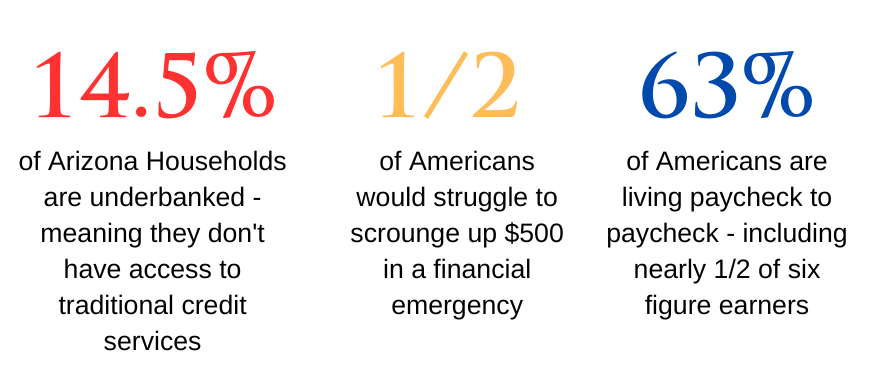

Arizonans Deserve Access To Credit In A Financial Emergency

14.5 percent of Arizonans are considered “underbanked” meaning they don’t have access to traditional credit services. Arizonans should have the right to make their own financial choices without the government telling them what they can or can’t do. From unexpected medical bills, automotive issues, or circumstances beyond their control, Arizonans need to have options available in an emergency.

Short-Term Borrowers Are Overwhelmingly Satisfied

A majority of short-term borrowers are overwhelmingly satisfied and value the products and services provided by short-term credit providers. Less than one percent of all complaints submitted to the Consumer Finance Protection Bureau (CFPB) were related to short-term credit products.

Regulating Short-Term Lenders Out Of Business Hurts, Rather Than Helps, Arizonans

Onerous financial regulations that essentially eliminate access to short-term credit, leads to higher bankruptcies, consumer complaints, more expensive borrowing options, and a market for unscrupulous lenders.

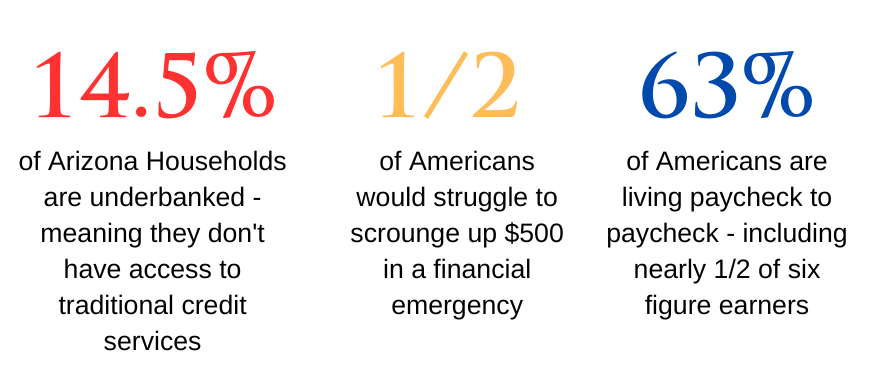

Arizonans Deserve Access To Credit In A Financial Emeregency

14.5 percent of Arizonans are considered “underbanked” meaning they don’t have access to traditional credit services. Arizonans should have the right to make their own financial choices without the government telling them what they can or can’t do. From unexpected medical bills, automotive issues, or circumstances beyond their control, Arizonans need to have options available in an emergency.

Short-Term Borrowers Are Overwhelmingly Satisfied

A majority of short-term borrowers are overwhelmingly satisfied and value the products and services provided by short-term credit providers. Less than one percent of all complaints submitted to the Consumer Finance Protection Bureau (CFPB) were related to short-term credit products.

Regulating Short-Term Lenders Out Of Business Hurts, Rather Than Helps, Arizonans

Onerous financial regulations that essentially eliminate access to short-term credit, leads to higher bankruptcies, consumer complaints, more expensive borrowing options, and a market for unscrupulous lenders.

Access To Credit Is CrucialFor Arizonans

Access To Credit Is CrucialFor Arizonans

Access To Credit Is CrucialFor Arizonans

Access To Credit Is Crucial For Arizonans